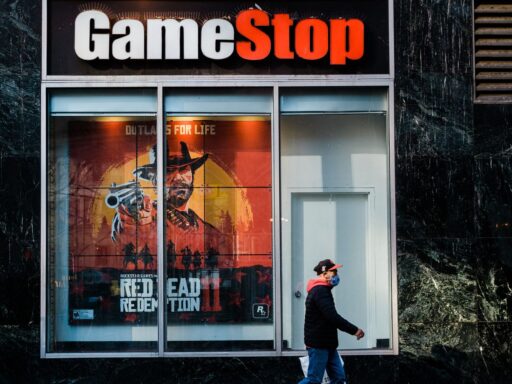

How a bunch of Redditors made GameStop’s stock soar, much to the chagrin of the hedge funds attempting to short it.

Who knew the first big 2021 stock market story would be … GameStop? But here we are.

There’s been a boom in day trading and individual investing over the past several months — activity that’s often taking place or being discussed on platforms such as Reddit and Robinhood instead of in more traditional arenas. And one big question amid the frenzy has been how much the little guys really matter. Sure, small-time investors trade a lot, sometimes to the annoyance of more traditional institutions, but are they really consequential?

When it comes to the GameStop saga, at least, the answer is yes. An army of traders on the Reddit forum r/WallStreetBets helped drive a meteoric rise in GameStop’s stock price in recent days, forcing it to halt trading multiple times and causing a major headache for the short sellers betting against it and banking on the stock falling.

Famed investor and CNBC personality Jim Cramer called the GameStop drama the “squeeze of a lifetime.” Bloomberg opinion columnist Matt Levine posited that one possible explanation for what happened could be “utter nihilism” on the part of the Reddit crowd, a story “perhaps best told with a series of rocket emojis.” Or maybe one of the WallStreetBets moderators put it best to Wired: “It was a meme stock that really blew up.”

There’s been a lot of hand-wringing about the day-trading trend and this new crop of investors playing the markets, many of whom are treating stocks more like a spin at the roulette wheel than a long-term strategy to build wealth. It’s not clear how many of them are looking at the underlying fundamentals of companies, or whether they’re just “YOLO-ing” themselves across the market.

On GameStop, the answer is probably a mix. There’s a reasonable business case to make for the game retailer’s valuation; there’s also a case that this whole thing has just been quite fun for everyone — the possible-trolls of Reddit, market watchers, commentators, and certainly GameStop — except for the short sellers, who have been in for a pretty miserable ride.

“It’s dramatic, and you don’t see this magnitude very often,” said Nick Colas, the co-founder of DataTrek Research. “But when it happens, it’s spectacular.”

This doesn’t mean GameStop’s stock price will stay up forever, or that the company is suddenly in a perfect spot. But if it were to, say, offer more stock, it would probably have some buyers.

An attempt at an explanation of what is going on here, for people who don’t follow markets at all

So let’s back up a bit to go over some of the very basics of what is even going on here, because it’s kind of a lot.

GameStop is a video game retailer headquartered in Grapevine, Texas, that operates more than 5,000 stores. Between malls dying out and the pandemic, if you forgot the company existed, that would be fair. But it’s still out there, trucking along. GameStop has become a popular play among short sellers, who are basically investors who think a stock will go down. In Wall Street terminology, these investors are bearish on a stock’s prospects. Again, dying malls plus pandemic. You get the reasoning.

Though the buying frenzy around GameStop hit this month, this one has been in the making for a while. Brandon Kochkodin at Bloomberg recently laid out how GameStop, which isn’t expected to even turn a profit until 2023, has seen its market skyrocket, and what Reddit has to do with it.

By Kochkodin’s recounting, a bull case for GameStop (basically, an argument that it’s stock is good) started showing up on WallStreetBets about two years ago and has, off and on, been bubbling up. Scion Asset Management, the hedge fund run by Michael Burry, who you might know from The Big Short, revealed he had a position in the company, which inspired some confidence, and then Ryan Cohen, the co-founder of the pet e-commerce company Chewy, disclosed last August that he had a big stake in GameStop. Earlier this month, he was added to its board. That’s been interpreted as positive for GameStop.

As Reddit and retail traders started to take notice of GameStop, they also took notice of how heavily shorted the stock was — information that’s generally pretty easy to get. And they figured out a way that, if they acted all together, they could sort of screw the shorts over and make a profit doing it. Kochkodin points to a post from four months ago starting to plot. Its subject: “Bankrupting Institutional Investors for Dummies, ft Gamestop.”

How a short squeeze is making Reddit happy and short sellers sad

GameStop’s stock price has skyrocketed by 400 percent from where it was at the start of the year at under $20 to more than $76 at market close on Monday. It’s been super volatile, even spiking above $150, thanks in no small part to Reddit and the short sellers its after. WallStreetBets has an antagonistic relationship with shorts — many retail traders are betting stocks will go up, not down.

Lots of hedge funds and investors are shorting GameStop, but at the center of the current saga is Citron Research, which is run by famed short seller Andrew Left. Last week, Citron announced on Twitter that it would be hosting a livestream event laying out the short case against GameStop and arguing people buying the stock were “suckers at this poker game.” They predicted shares would go back to $20. The event was put off, first because of the presidential inauguration, then because of attempts to hack Citron’s Twitter. Eventually, they got the video out, and the battle has continued. Left has said he’ll no longer comment on GameStop because of the “angry mob” that’s formed against him and complained he’d “never seen such an exchange of ideas of people so angry about someone joining the other side of the trade.”

Retail traders have been able to orchestrate what’s known as a short squeeze against Citron and the others betting against GameStop, which screws up the short trade and drives the stock price up. (Don’t worry, we’ll explain what that is.)

When a hedge fund or investor shorts a stock, they basically speculate that its price will go down. They do that by borrowing, usually from a broker-dealer, shares of a stock that they think will lose value by a set date and then selling them at the market price. “It’s a much more sophisticated investor kind of play,” Colas said. “[The bet] has to work pretty quickly, because what you don’t want is your short stock at $10 and it goes up to $100, because you can lose more than 100 percent of the capital that you put down.”

When you short a stock, you have to at some point buy back the shares you borrowed and return them. If the trade works, you buy them at a lower price and get to keep the difference. But if the price of the stock goes up, it doesn’t work. At some point, you’ve got to buy the stock back and return it, even when the price is higher and you’re going to lose money.

What happens with a short squeeze is that when the price of the stock being shorted starts to climb, it forces traders who are betting it will fall to buy it to try to stem losses. That winds up driving up the price of the stock even higher, so it’s a bit of a double whammy for shorts. The worst-case scenario is, theoretically, unlimited.

“The short squeeze is when somebody says, ‘Oh, I know a lot of guys are short. I’m going to go long and make them buy the stock back even higher,’” Colas said.

To add on another layer to this, a lot of the activity around GameStop hasn’t been people directly buying the stock but also buying call options, where they basically gamble that it will go up. It’s complicated, but the takeaway is that call option buys may have also driven up the stock because the market maker selling those options hedges by buying more stock. And there was a lot of options buying, namely among day traders — volumes have skyrocketed, and one WallStreetBets trader claimed to have turned $50,000 into $11 million playing options.

Levine summed up what amounts to a snowball effect here:

Something started the ball rolling—the stock went up for some fundamental or emotional or whatever reason—and then the stock going up forced short sellers and options market makers to buy stock, which caused it to go up more, which caused them to buy more, etc.

The shorts are definitely hurting: Melvin Capital Management, a hedge fund betting against GameStop, is down 15 percent in just the first three weeks of 2021, according to the Wall Street Journal. It’s had to call in some help.

“They’re smarter than we think”

The GameStop episode is a mix of serious and silly — part retail traders demonstrating some actual power in the market, part accepting that some of this just makes no sense. Whether GameStop took off because it’s a meme stock — a stock about which interest is as much cultural or social as it is financial — or because there is something to the business case is unclear. There is a business case, there is a cultural interest; the balance between the two in driving the price is indeterminate. Part of it might basically be a joke. What is clear is that a lot of what’s happening with the stock now isn’t because of a potential turnaround; it’s because the trade went viral.

“It doesn’t make business sense,” Doug Clinton, co-founder of Loup Ventures, told Bloomberg. “It makes sense from an investor psychology standpoint. I think there’s a tendency where there is heavy retail interest for those types of traders to think about stocks differently than institutional investors in terms of what they’re willing to pay.”

Day traders are hardly a monolith, including the ones at WallStreetBets, which boasts 2.2 million members, or as they refer to themselves, “degenerates.”

But just because this is a bit of an odd (and somewhat unexplainable) episode doesn’t mean it doesn’t signal some bigger things that are important.

For one thing, it seems like the WallStreetBets crowd has learned a tactic that it can replicate in orchestrating short squeezes. “What they’ve done is target large short positions,” Cramer said on CNBC on Monday. “They’re smarter than we think. They’re after the ones that are too shorted.”

Some observers have raised questions about whether what’s happened with WallStreetBets and GameStop might draw regulatory scrutiny and whether this might count as market manipulation. Colas said he’s doubtful there’s much of a case for that here. “Everything is known. There’s no insider information here,” he said. If a hedge fund shorting a stock can put out a presentation and video about why a company is bad, why can’t random people talking to each other on the internet talk about why a company is good?

To be sure, on the legal front, reasonable minds might disagree.

One of WallStreetBets’s moderators addressed the impression that the community is “disorderly and reckless” in a post on Sunday while at the same time pushing back against any suggestions there’s an organized effort among moderators to promote or recommend any stock. “What I think is happening is that you guys are making such an impact that these fat cats are worried that they have to get up and put in work to earn a living,” the moderator wrote. “Some of these guys [who] traditionally used the media as a tool for them to manipulate the market have failed to further line their pockets and now want to accuse you guys as being manipulators.”

GameStop has been the perfect storm for the current retail trend. It’s a recognizable name, there’s some business case for it, and it’s turned into a meme. And it’s heavily shorted, which is bound to irk the recent crop of retail traders who subscribe to the mantra that “stocks only go up.”

This isn’t the first time day trading has become trendy, nor is it the first time day traders have been accused — often rightly — of being a little bit reckless. Last summer, a bunch of them piled into bankrupt Hertz, for which there was really no good case. Many of them treat trading like a game, which can obviously be dangerous. But it’s hard to root against them. Plenty of hedge funds, short sellers, billionaires, and institutional investors treat investing like a game, too. And every once in a while, they’re bound to lose, too, even to the little guys.

Author: Emily Stewart

Read More