Our tax system is impenetrable, needlessly complex, and intrusive about our personal lives.

I love taxes.

I relish doing my own taxes; I wake up every New Year’s like Ned Flanders, eager to fill out my 1040 as soon as possible and impatient that I don’t have my W-2 yet. But it’s more than that. I cut my teeth as a reporter on the budget battles of Obama’s first term, much of which hinged on the fate of Bush’s tax cuts, set to expire in 2010 and then again in 2012.

Even earlier, when I was in middle school, I remember my mom ordering me to go to bed when I was staying up late on my lime green iBook trying to draft a new tax code; the problem wasn’t that I was up too late but that I was getting too angry at the state of the tax code and she thought I could use some rest.

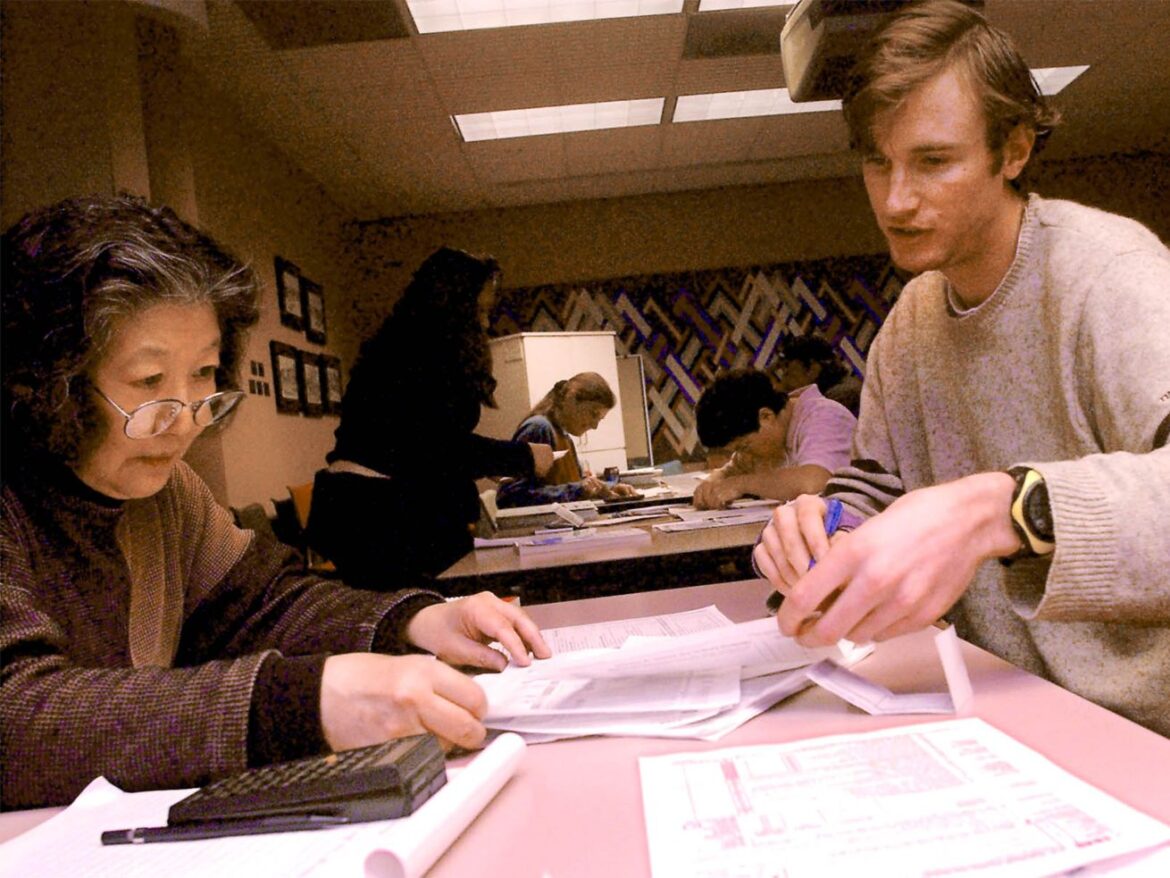

So it’s probably unsurprising that I wound up volunteering for VITA: the Volunteer Income Tax Assistance program, an IRS-led endeavor in which local nonprofits provide tax preparation services free of charge. The services are aimed at people with limited English, disabilities, and/or income below $60,000. That’s obviously a lot of people, and the office gets busy, particularly as the mid-April deadline approaches.

I’ve volunteered for four years now; some of my VITA colleagues have been at this for decades. It’s immensely rewarding, but it’s also changed the way I think about, and write about, the tax code.

Reporting on congressional fights about taxes gives you an excellent view of why the code is the way it is from policymakers’ point of view. That’s a good vantage point for understanding how the code came to be, but a bad one for understanding how well the code is working.

If a 23-year-old office cleaner were to ask me to explain why she can’t get the earned income tax credit (EITC), the main tax provision meant to help working people near the poverty line, I could recall my old reporting and say that it’s because she’s too young and has no kids; childless people didn’t get the EITC at all until 1993 — and then only because Rep. Charles Rangel (D-NY) cut a deal with skeptics who worried about it going to college students with rich parents — but only those 25 and over.

That, however, doesn’t explain why it’s fair or appropriate for her to not get the help she’d get if she were two years older.

That’s a small example — and a fictional one; I’m not going to violate anyone’s privacy by discussing specific tax situations — but there are some larger lessons I’ve gathered too.

I should be clear that these are my views and I speak for none of my fellow VITA volunteers or the wonderful organization itself. I’m just offering my own take on what policymakers could do to make life easier for our clients.

You gotta withhold

The return you want to be handed as a tax preparer, the easiest possible one to deal with, is a “one W2.” That means a taxpayer who has one job, where they’re classified as a normal employee, get paid a wage from which taxes are withheld, and has no other income.

These returns are easy; you just type the W2 into TaxSlayer, the software VITA uses, and you’re basically good.

Many returns aren’t “one W2”s, and often due to no fault of the taxpayer. The most common scenario is gig economy work. Typically, employers like Uber, Lyft, DoorDash, etc. do not treat their workers as normal employees, do not withhold income or payroll tax, and do not issue W-2s.

Instead they issue 1099–NECs (non-employee compensation), for the income they paid to their workers as independent contractors. I’ve also increasingly seen people bringing in 1099-NECs totaling well into the five figures from what sound like pretty normal jobs in retail or food service or janitorial work that one would think should provide W-2s.

Almost without fail, this approach winds up screwing workers. 1099-NEC workers tend to come in without having withheld any of their income to pay either income or self-employment tax during the year. We often learn together that they owe thousands of dollars to the IRS, plus perhaps a penalty because they didn’t make quarterly tax payments like they were supposed to.

This has to stop. It’s not fair to ask workers in disproportionately low-paying jobs to sock away hundreds or thousands of dollars a month for tax payments when they’re living paycheck to paycheck. If the government is going to claim that money in taxes, it should enforce stricter withholding rules on companies with large independent contractor workforces so workers aren’t surprised every April.

We need to decide what a child is

On its face, deciding who counts as a child and who doesn’t seems like an easily solvable problem, but it’s actually not — and it’s hugely consequential.

There are at least three definitions of “child” for tax purposes. One definition allows parents or guardians to claim a larger EITC. A different definition allows a child’s parent or guardian to claim head-of-household filing status, which offers advantages relative to filing as a single person. Then there’s the definition of a “child” for the purposes of the child tax credit (CTC), which takes up to $2,000 per child off families’ tax bills.

These are overlapping but not identical categories, and I’ve seen no small amount of confusion from preparers and taxpayers struggling to figure out if a kid is a child for CTC and head-of-household purposes, or just one of the two, etc.

This sounds preposterous, I know, but just look at the decision tree the IRS provides to VITA volunteers to figure out if a child qualifies for the EITC, just one of the three definitions above:

VITA/TCE Volunteer Resource Guide

This is from the 4012, the tax volunteer’s bible. On page 176, you can find the equivalent table for the child tax credit; on page 52, the one for head-of-household status.

The differences are subtle, but significant. If a child is 18 and married? Eligible for the EITC, but not the CTC or HOH (but you could get the ADC — the Additional Dependent Credit, a whole different tax credit!). Eighteen and unmarried? Then HOH is on the table but not CTC (don’t forget about ADC though).

This is … ridiculous. It’s marginally less ridiculous thanks to the Trump tax cuts, which consolidated the child tax credit and “personal exemptions” for dependent children into one enlarged credit. But that just wiped the frosting off a moldy cake. You have to throw the whole cake in the trash.

The minimalist approach to fixing this would be to rewrite the law so that any child who qualifies their parent or guardian for the EITC also counts for HOH and CTC.

A better, more ambitious approach would be to try to consolidate these various benefits for families with kids. There are various ways to do this. The easiest would be to follow the End Child Poverty Act and replace the child tax credit and the child portion of the EITC with a single monthly check for all children (though even that bill falls short because it doesn’t end head-of-household status). If policymakers are worried that such a benefit would discourage work, they could replace all three provisions with a phased-in monthly check based on the previous year’s earnings.

Whatever your views on the optimal underlying policy here, there’s no reason why the presentation and implementation have to be this complicated.

The government would like to know about your marriage

Being a tax preparer means asking total strangers about some of the most intimate aspects of their personal lives, repeatedly.

Even in a simplified world where the government sent out checks for each child in the mail (as happens in much of the rich world), the government would still need to know where to send that check, and would need a test to determine which adult or adults in a child’s life should get it.

Along those lines, the government also demands to know about marriage. The whole income tax code is organized around marital status: Your marriage or lack thereof determines what filing status you can choose.

Filing status determines what standard deduction you can claim and when different tax brackets kick in, which for many tax filers is the most important factor in how much they pay. If you’re married, you can file jointly with your spouse, or separately — but the code is set up to heavily penalize you if you file separately.

In reality, life is messy. Sometimes people get married and drift apart. The tax code makes some allowances for this, but the EITC, for instance, requires people to either be legally separated or live apart for the last six months of the year to claim the credit while married filing separately. If you move out in July and your spouse won’t grant a legal separation? Or you live in a state where legal separations aren’t allowed? Tough luck — either you file with your spouse anyway or you don’t get the credit.

These situations are hard enough to live through; it’s worse when you have to explain to a stranger preparing your taxes (like me!).

More generally, joint filing creates a strange system where some filers are heavily penalized, and others rewarded, for getting married. A Tax Policy Center study from earlier this year estimated that 43 percent of married couples pay more in taxes (averaging $2,064) for being married; another 43 percent pay less (averaging $3,062). For only 14 percent of taxpayers does marriage make no difference. In general, the bonuses go to couples with unequal earnings, such as those where one partner doesn’t work, while those with equal earnings are penalized.

In practice, it’s a factor pushing women out of the workforce. This has been found in numerous high-quality studies across numerous countries. One recent paper estimated that in the US, eliminating joint filing would increase married women’s participation in the labor force by more than 20 percentage points until age 35; the effect diminishes a bit with age but remains large. Given that there are about 11 million married women under 35 in the US, that implies some 2.2 million more workers, which could have significant positive economic ramifications.

The solution is to get the tax code out of the marriage business. Most rich countries have abandoned joint tax filing altogether: A 2017 survey from Deloitte found that 62 percent of countries surveyed, including the UK, Canada, Australia, and all of Scandinavia, require that individuals pay taxes on their own and disallow joint filing.

Eliminating joint returns, and moving to a system where everyone has the same filing status, would create winners and losers, but it would treat couples equally regardless of earnings, and it would make life vastly simpler for the millions of Americans who do not fit neatly into the IRS’s categories.

Should this really be in the tax code?

/cdn.vox-cdn.com/uploads/chorus_asset/file/24583424/1235588015.jpg)

Terry Pierson/The Press-Enterprise via Getty Images

The main tax credits we deal with in VITA are the EITC and CTC, which have their complexities (see above).

After that, the most common are the education credits: the refundable American opportunity tax credit (AOTC), which covers four years of undergraduate college education, and the lifetime learning credit (LLC).

These credits have subtle differences that become important: The AOTC, for instance, bars students with felony drug convictions from collecting the credit, which the LLC does not; but the AOTC can also be used for the cost of books and materials that are helpful but not explicitly required for classes, which the LLC cannot.

This is all a significant headache for affected taxpayers — and I can say from experience that asking, “Have you been convicted of a drug-related felony?” does not become an easier question to ask the more you ask it.

A common proposal from higher ed wonks is to fold these credits into an increase in the value of Pell Grants, which are a well-targeted program aimed at students from families with low incomes and which don’t require a complex tax return to receive. That’s a very good idea, and one worth applying to a number of other less-used provisions too.

The child and dependent care credit (CDCC, not to be confused with the similarly named, much larger child tax credit) is a mess. This is a credit meant to defray the cost of child care, nannies, preschool, and related services.

Most clients I work with who have kids in day care are not eligible for it because you have to owe income taxes to get it, and most low-income people don’t owe income taxes; they file to get “refundable” credits that people who don’t owe can receive. One solution would be to make the CDCC fully refundable — but a better one would be to remove this complication from the tax code entirely.

The leading Democratic proposal on child care, Sen. Patty Murray’s (D-WA) Child Care for Working Families Act, would offer funds to state-run programs that provide subsidies directly, so people can get the money when they need it to pay child care bills, rather than at the end of tax season.

That plan has its own problems, but it gets that part right. Not everything has to be in the tax code.

A world without tax filing

If you add up the suggestions above, you get a vastly simpler tax code. Indeed, they put you in a good position to implement a system in which very few people have to file income taxes.

In a 2019 paper, economists Jeffrey Liebman and Daniel Ramsey ran through the changes the US would have to make to adopt this system of exact-withholding. Under this approach, used by the UK, Japan, and others, “the majority of taxpayers do not need to file tax returns. Instead, these countries use withholding systems in which the correct amount of tax is withheld during the year.”

That could be us — so why isn’t it? They offer four big aspects of the US tax code that prevent it.

The first is the complex system of benefits for families with children. Creating a simple monthly child benefit would solve that.

The second is that capital income like interest and stock capital gains aren’t “taxed at the source”: your broker doesn’t automatically tax, say, 30 percent of the proceeds from selling stock and send it to the IRS. Creating a flat tax on capital imposed at the source would eliminate filing requirements for most people with this kind of income.

Third is the numerous deductions in the tax code. Most of these, like the mortgage interest or charitable deductions, don’t come up much in VITA because it’s almost always more advantageous for clients to claim a standard deduction — but things like the education credits do come up, and removing them would simplify our clients’ lives.

Fourth and most important is eliminating joint returns and moving to individual-based taxation. Joint filing makes precise withholding much more difficult because employers would need to know the earnings of each of their employees’ spouses in order to withhold correctly. If everyone’s taxed as an individual, then eliminating joint filing wouldn’t mean couples would have to file two returns: They’d have to file zero because precise withholding would be possible.

In this kind of world, VITA wouldn’t necessarily run out of clients. Even in a world where Uber and DoorDash got better about withholding, we’d still have some clients with complex self-employment situations that they’d need help with.

But our client base would be much, much, much smaller. Nothing would make me happier than to know the IRS made our clients’ lives easier so that my colleagues and I don’t have to. If the system became more functional, our obsolescence would be a happy development.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24583414/image1.png)