The average American probably doesn’t know about all the free money in the Inflation Reduction Act.

The Inflation Reduction Act turns one year old this week. The law is President Joe Biden’s biggest climate achievement to date, with nearly $370 billion available for clean energy and climate programs. But just how much that investment will benefit the average American and the environment remains an open question.

Aspirationally, the IRA is designed to lead to a major reduction in US greenhouse gas emissions. Its programs incentivize technology that would bring clean energy to American homes, transportation networks, and manufacturing. Because most of the IRA’s funding spans the next decade, the Biden administration is still working to develop the rules for dozens of new programs, including a new fee on methane pollution, guidance for hydrogen tax breaks, and pollution grants for communities. But programs that give rebates to consumers for energy-efficient home improvements and home electrification will hit the market next year, offering the first test case of the law’s effectiveness to move Americans on from fossil fuels.

The IRA also comes with some political baggage. Democrats passed the law on a strictly party-line vote, and climate experts have criticized the final version of the IRA for relying more on incentives to entice voluntary adoption rather than penalties to enforce pollution cuts. Meanwhile, Biden is betting that the new law will deliver most of the emissions cuts needed to meet the US’s goal of halving pollution from its peak 2005 levels by 2030. But analysts’ projections, which are based on a number of assumptions and caveats about the next decade, estimate the IRA will only deliver about 40 percent in emissions cuts. Not meeting that goal would undermine the law’s climate ambitions, both harming public support for federal climate efforts and giving Republicans political ammunition for undoing them.

Others argue that the IRA has already made a significant impact on the economy, spurring tens of billions of dollars of planned investment in new factories and plants and kick-starting growth in electric vehicles. The IRA’s generous tax breaks, combined with complementary programs in the bipartisan infrastructure law and the CHIPS and Science Act, have spurred billions of dollars in announcements for new factories and expansions of US manufacturing.

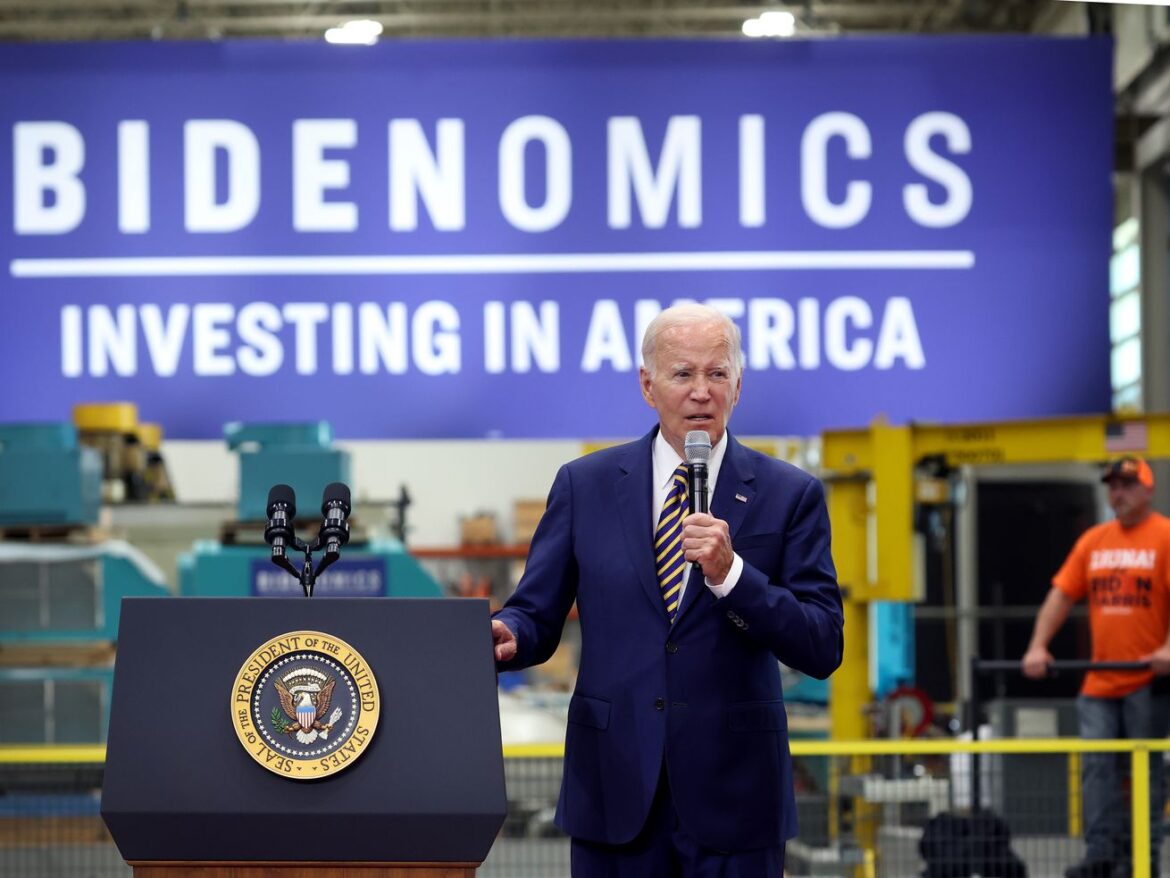

The IRA is still young and there’s still an optimistic outlook for its future. But as the ambitious law wraps up its first year of enactment, the IRA’s main challenge going forward is that so few Americans realize how the IRA is ushering in change — a failure that could hurt the law’s implementation and even cost Biden reelection.

The IRA’s success in manufacturing

Industrial groups have been celebrating the IRA as a game changer since the bill’s passage last year. The law offers generous tax credits and payments rewarding investment in US-based jobs and manufacturing, and the private sector has been quick to take advantage. Dozens of companies have announced ambitions to build battery and solar plants, expand into mining, and manufacture more consumer products domestically.

“This is the most amazing thing we’ve seen in the United States for a very long time,” US Steel Corp. CEO David Burritt told Bloomberg Television in late July. “It’s a Manufacturing Renaissance Act.”

General Motors has put money into developing a mine in Nevada to source metals needed for EV batteries. Solar panel producer Qcells plans a major expansion in solar manufacturing in Georgia. LG Electronics, meanwhile, is working to open a new factory to manufacture electric heat pumps made entirely in the US.

Abigail Ross Hopper, president and CEO of the Solar Energy Industries Association, this week hailed the wave of “unprecedented” announcements for new solar. On the same press call, American Council on Renewable Energy president Gregory Wetstone similarly proclaimed that, in his career, he hasn’t “ever seen a law have a greater impact on the economy in this country.”

Overall, E2, a group representing clean energy business leaders, counts 210 projects announced, which would translate into $86 billion in new investment across 39 states. When combined with the investment from the CHIPS and infrastructure laws, those estimates could go as high as $230 billion. And that’s just private investment. The White House counts about $70 billion in grants, rebates already underway, and $12 billion in low-cost loans guaranteed by the federal government.

These investments have made a bigger contribution to GDP growth than the US has seen from manufacturing in the last 40 years, according to the White House’s numbers, reversing shrinking manufacturing. By 2024, solar panel manufacturing is expected to increase eightfold compared to where it was in 2019. Semiconductor and clean energy manufacturing is up 20 times compared to 2019.

The White House says that, in the next seven years, it expects the number of solar, wind, and battery storage projects to increase at twice the rate it would have grown if the IRA hadn’t passed. And it seems to be trending that way, with those sectors already overtaking fossil fuels in terms of new projects launched.

The biggest wave has been in EV battery manufacturing. Car manufacturers like Toyota, GM, Honda, and Ford have all announced plans to assemble batteries in the US, and analysts expect EV battery manufacturing to double and become sufficient to meet domestic demand for EVs by 2030. Projects slated for the so-called “battery belt,” which stretches from the Great Lakes states down to Georgia, will bring jobs to more than 100 facilities in the US, according to Canary Media, and much of that development is concentrated in red states.

It wasn’t inevitable that the IRA’s impact would be so successful so quickly in the US. One of the more controversial provisions of the IRA was that manufacturers of EVs and heat pumps, as well as solar and wind hardware, could only benefit from generous tax breaks if they produced a portion of their equipment in the US. This would represent a substantial shift in supply chains and investment that may not happen fast enough to meet rising demand for clean energy. The requirements also bore some diplomatic consequences with the EU and Japan.

That said, early reviews suggest that the IRA’s massive experiment in “reshoring” manufacturing is working. But it’s too early to know if this success will last. One year in, manufacturers’ plans to build are still just plans, not actual steel in the ground. It’s possible for obstacles like permitting to derail these investments or for private capital to fall through. For example, a July report from the analyst group BloombergNEF noted its skepticism of the US’s ability to build up its capacity for solar technologies.

The IRA’s problem with public awareness

Manufacturing is just a slice of what the IRA is supposed to tackle. For interested homeowners and consumers, however, it also means a major transformation of the home.

“The core of the IRA is around the incentives for homes, energy, cleaner energy in homes,” Schneider Electric’s vice president for government relations Jeannie Salo told Vox. “We haven’t even seen what the IRA is going to do in terms of consumer demand.”

But in order to do that, the benefits the IRA offers need to make a jump from relative obscurity to the mainstream conversation. The law’s success depends as much on Americans hearing about how they can lower their energy bills while also cutting their climate footprint as it does on a boost in green manufacturing. Because the IRA’s rebates and tax credits are voluntary, public perception of the law’s impact will depend on how many people know about and take advantage of these incentives. This also inevitably affects voters’ perception of Biden, which has implications for the future implementation of the law. Should a Republican win the presidency in 2024, some parts of the law could be at risk of repeal.

And so far, few Americans — less than a third — have heard anything about the IRA, let alone its tax credits for consumers, according to a July poll by the Washington Post- University of Maryland. An interesting correlation from that poll: A majority of participants disapproved of Biden’s climate policies, and those who had heard little to nothing about the IRA were more likely to disapprove. Other polling, including from the Yale Program on Climate Change Communication, has similarly found that most registered voters know little about the IRA.

The political implications for widespread consumer awareness of the IRA’s benefits could be significant. After all, in order for people to reap the rewards of the IRA’s tax incentives and rebates, they first need to understand what the law offers. The Biden administration is also banking on red states to take advantage of the free money. If the programs become popular and the tide turns, we could eventually see a country that’s less divided on climate action.

Another danger in low public awareness is simply that the less understood the law, the more susceptible it is to politicization. Climate activists and progressive Democrats learned this lesson in 2020, when talk of a Green New Deal burst on the scene. Voters weren’t familiar with the catchall name for an aggressive climate platform that the likes of Alexandria Ocasio-Cortez and Bernie Sanders had embraced. That left room for Fox News to pounce and define it themselves, in negative terms, for voters.

Proponents of the IRA agree that low consumer awareness could pose a problem for the rollout of rebates and state programs next year — and eventually Biden’s future in office. But Leah Stokes, a University of California Santa Barbara political scientist who advised Democrats in crafting the law, hopes that the lack of awareness will be a different story by then since, she said, “a lot of money will be flowing.” She wouldn’t stand by all the decisions Biden has made on climate change, but also thinks he deserves more credit that the US finally has a significant climate law.

“It’s early days in terms of the transformation that’s coming,” Stokes told Vox. “I hope people will realize the next election will be between a president that put a huge amount of energy to get the IRA across the finish line, and the Republican party that is trying to dismantle environmental regulations.”